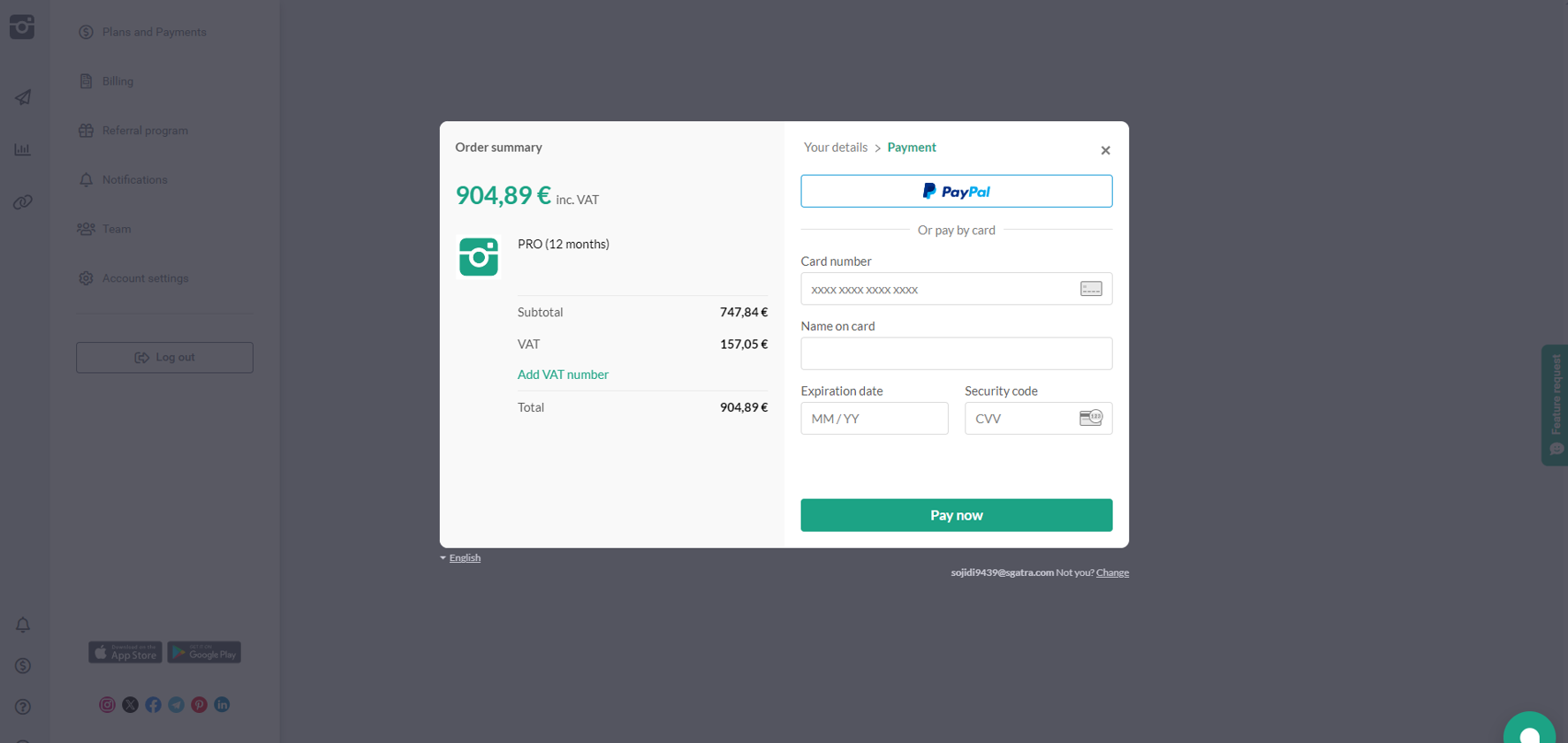

Paying for a plan, choose the payment method of your preference. The following payment methods are available.

Note:

1) The list of payment service providers and payment methods depends on your location.

2) Choose your local currency when paying. If the local currency is unavailable, choose any other currency, and it will be converted according to the rate of your bank.

3) All license fees quoted on our website are exclusive of sales taxes or any other taxes that may be applicable in your jurisdiction. *

4) When making a one-time payment, your accounting period will be extended to compensate for your tax charges.

1. PayPal

You can use a personal PayPal account or a business PayPal account.

Note:

PayPal cannot handle transactions between two business accounts according to the laws. When using a business PayPal account, your payment will be processed by another system.

2. Paddle

You can pay with a bank card or using your PayPal account when choosing Paddle.com. Note that a payment amount may be automatically increased in case of charging an indirect tax.

Paddle.com is held responsible for correct tax charges. For more details, please see the information here.

Note:

When making a one-time payment, your accounting period will be extended to compensate for your tax charges.Note:

Should you have any issues with the payment process, please write us at support@onlypult.com.

* A Sales Tax means any indirect tax chargeable on the sale of license globally, including but not limited to VAT, GST, Sales Tax, and Sales & Use Tax. As a client, you are responsible for paying all taxes on all license fees (if any) you pay to our company.